Muhurat Trading 2023: A Comprehensive Overview

Diwali is one of the biggest festivals celebrated in India and embraced by millions across the globe. The Festival represents the victory of light over darkness, knowledge over ignorance, and good over evil. On this auspicious day, many people indulge in religious, traditional, and custom activities. One such convention is Muhurat Trading.

Samvat 2080 marks the beginning of Vikram Samvat, the Hindu new year. According to the lunar calendar followed in India and Nepal, Vikram Samvat starts with the festival of Diwali. People also perform the Lakshmi Puja on this day, praying to the Goddess of Wealth to bless their families with happiness and prosperity.

The one-hour-long special trading session is convened on the day of Diwali in the Indian stock market. It holds great significance for investors and traders alike.

In this blog, we will delve into Muhurat trading, exploring its history, tradition, significance, and how it has become an integral part of the Indian financial ecosystem.

What is Muhurat Trading?

Muhurat, meaning 'auspicious time' in Hindu customs, represents a phase to begin something good. This word has a great impact on the Indian stock market. Stock traders and investors observe Muhurat trading during Diwali. They believe that investments into stocks will help them in achieving their long-term financial goals for themselves and their family members.

The stock exchanges design a one-hour trading session on Diwali each year. These new beginnings are done at the right and auspicious time to roll out a long-term vision of financial goals. This distinctive tradition involves individuals buying stocks symbolically to honor Goddess Lakshmi, the divine figure linked to affluence and prosperity.

This special event has been followed in India by investors and traders, stock brokers, and market enthusiasts for many years now. On every Diwali, investors across the country engage in special trading sessions with the hope of keeping the upcoming year opulent.

Usually, the stock market remains closed throughout Diwali. Only a special one-hour window is opened, permitting traders to make trades.

Muhurat trading lasts for approximately one hour, during which it is divided into several time slots. People are allowed to invest and trade stocks, derivatives, commodities, and other assets during this time.

History of Muhurat Trading

In India, business owners and stock brokers observe the festival of lights, Diwali, as the beginning of a new year. They engage in activities like opening new accounts for the fiscal year, symbolizing the financial beginning. On the other hand, people also worship Goddess Lakshmi for a wealthy and prosperous year.

While a multitude of auspicious activities happen across India on Diwali, the stock market celebrates this occasion through a one-hour trading session. The practice of Muhurat trading dates back to the 1950s. Originating at the Bombay Stock Exchange (BSE) in 1957, the tradition was adopted by the National Stock Exchange (NSE) in 1992.

Although Muhurat trading doesn't typically guarantee profits, it is believed to have a positive impact on one's wealth throughout the year. As time passed, Muhurat Trading lived up to the investors' expectations with great performance. It led more people to participate in this tradition over the years.

The Proceedings of Muhurat Trading

On Diwali, BSE and NSE allow investors and traders to indulge in stock tradings for a limited time. The one-hour trading session is divided into many parts as follows.

- Block Deal Session– Two parties reach an agreement to purchase or sell shares at a prearranged price, and then they notify stock exchanges to carry out the transaction.

- Pre-open Session– Timed for eight minutes, the session determines the equilibrium price set by the stock exchanges.

- Muhurat Trading Session– The main session where trading takes place.

- Call Auction Session– Involves trading illiquid securities. Securities are termed illiquid if they satisfy the criteria set by the exchange.

- Closing Session– The end of the special session where traders and investors place a market order at the closing price.

Muhurat Trading 2023: Timings and Date

Muhurat trading will take place on the 12th of November 2023, Sunday. Unlike the usual trading day, the Muhurat trading window is only open for an hour at a pre-decided time.

The pre-opening session will begin at 6.00 PM and last for fifteen minutes. Subsequently, the trading session will open at 6.15 PM and conclude at 7.15 PM.

| Session | Time (IST) |

|---|---|

| Pre-Open Session | 6.00 PM – 6.08 PM |

| Muhurat Trading | 6.15 PM – 7.15 PM |

| Post-Close Session | 7.30 PM – 7.38 PM |

| Market Closing | 7.40 PM |

Muhurat Trading Performance Over the Years

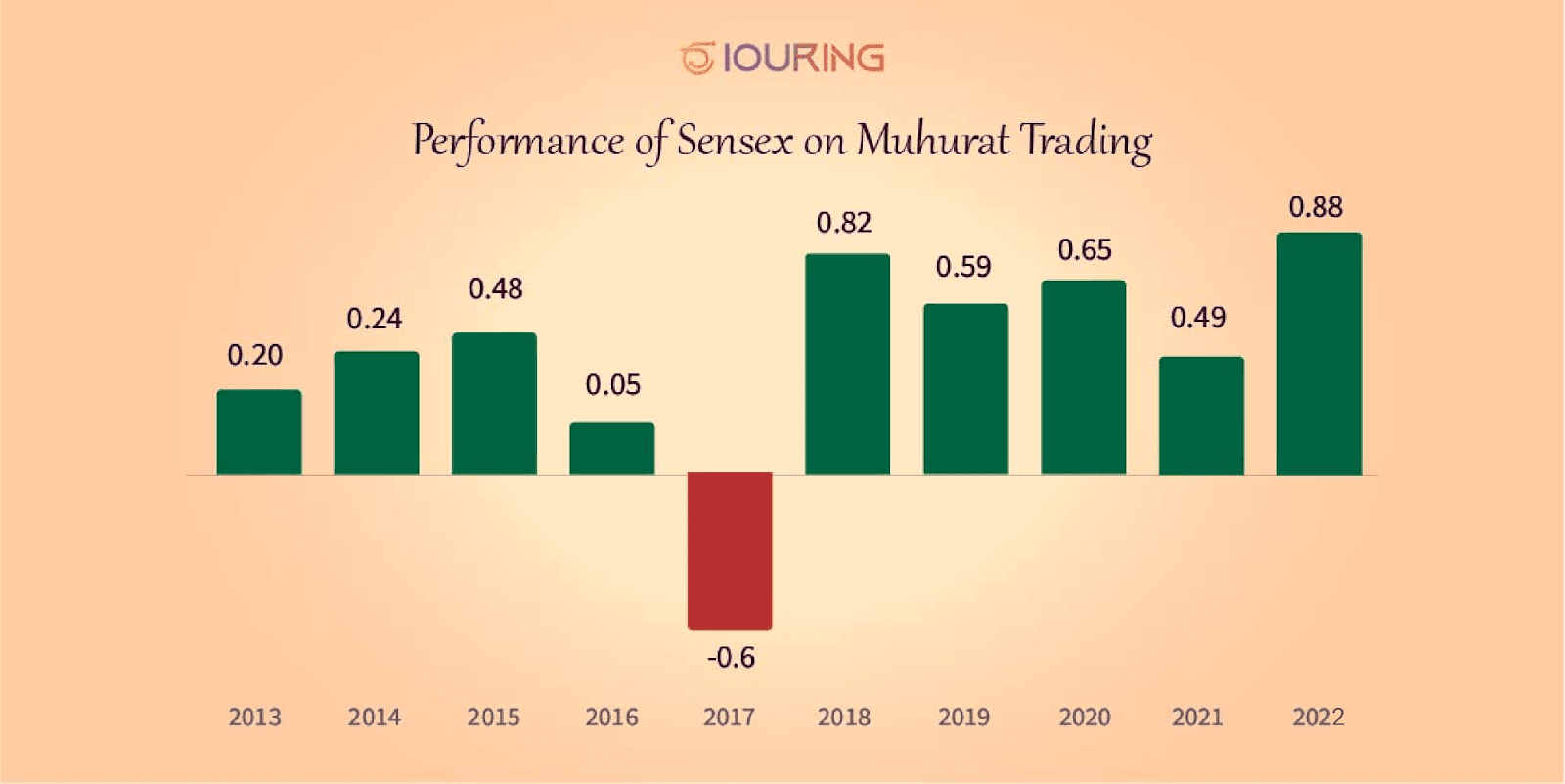

While Muhurat trading was originally just seen as an auspicious activity, it has proved to be a great time to make investments over the past few years. The trading session had a significant impact on the Sensex and Nifty indices in the previous years.

Historically, Muhurat trading has shown positive results for investors and has also triggered a bullish trend in the coming days or weeks.

In 2008, the SENSEX index registered a record 5.9% growth on the auspicious day. Similarly, 2018(0.82%), 2019(0.59%), 2020(0.65%), 2021(0.49%), and 2022(0.88%) saw positive gains. Therefore, Muhurat trading has evolved and become an optimistic time for traders and investors alike.

Samvat 2079 was a year filled with ups and downs for the Capital Markets. The path since the previous Diwali commenced with key indices reaching all-time highs in December 2022, subsequently dropping to 52-week lows in March, and rebounding to peak levels in September.

When the US was limped by the collapse of Silicon Valley Bank resulted in a major banking crisis in the US, Indian stock also had a rough time. With the short-sellet's report on Adani coming out in the meantime, Nifty slides to 17,000 in March 2022. However, the Indian stock market made a comeback as Nifty hit 20,222 and Sensex touched 67,900 in September of the same year.

The Indian market delivered respectable returns, nearing 10%, surpassing the average inflation rate of 5.85%. Overall investor wealth expanded by Rs.46 trillion, a 17% increase, reaching Rs.320.3 trillion.

In Samvat 2079, the Sensex advanced by 9.3%, and the Nifty rose by 10.3%, contrasting with the preceding Samvat when both indices were at -0.8% and -1.4%, respectively. The big gainers of the season were Nifty Midcap (24%) and Nifty Smallcap (31%). If we take a sectorwise look, Nifty Real Estate gained 37.5%, and Nifty PSU Bank procured 42.6 % while Nifty Auto and Nifty FMCG achieved 18.6% and 15.7% respectively.

Things to Keep in Mind Before Indulging in Muhurat Trading

While Muhurat trading is seen as a great day to start or pump up your trading journey, here are a few things in mind before immersing in it.

- Most traders and investors see Diwali as a favorable occasion to make investments.

- Settlement obligations will arise for all open positions when the trading session concludes.

- In 2023, the Muhurat trading session will take place on the 12th of November, Sunday.

- Traders have to keep a close eye on the price as the market tends to be volatile with no specific direction.

- Investors must do a thorough fundamental analysis before investing in stocks for the long term.

Embracing Tradition: Muhurat Trading with IOURING

Muhurat trading is not just a financial event; it is a cultural and spiritual occasion for the world of finance and faith. By indulging in stock market activities on this auspicious day, investors go beyond embracing financial gains. They believe in obtaining hope and positivity that the day entails.

Unlock stock market excellence with IOURING. This Muhurat trading, streamline your client-broker relationship with our products- NxTrad, NxtOption, and EKYC. Our new launch, EKYC, helps your customers onboard trading in five simple steps.

Check out our products and empower your clients with the market-best mobile and web trading solutions.